Everything You've Ever Wanted to Know About Financial Planning

Translation missing: en.blogs.article.author_on_date_html

Wellness

Everything You’ve Ever Wanted to Know About Financial Planning

January 11, 2021

Talking money isn’t easy. If you’re the kind of person who logs into your bank account with eyes closed or experiences that particular breed of dreadful panic when an unfamiliar bill arrives in the mail…well, you’re certainly not alone. Thankfully, Cristina Livadary and Stephanie Bucko from Mana Financial Life Design are here to help. With a clean slate and a refreshed mindset, we’re starting 2021 off with some financial guidance in the form of money-saving tips, budget-friendly basics, and mantras meant for every type of spender. Read on for their comprehensive guide to saving, investing, and getting your finances in order, anxiety-free.

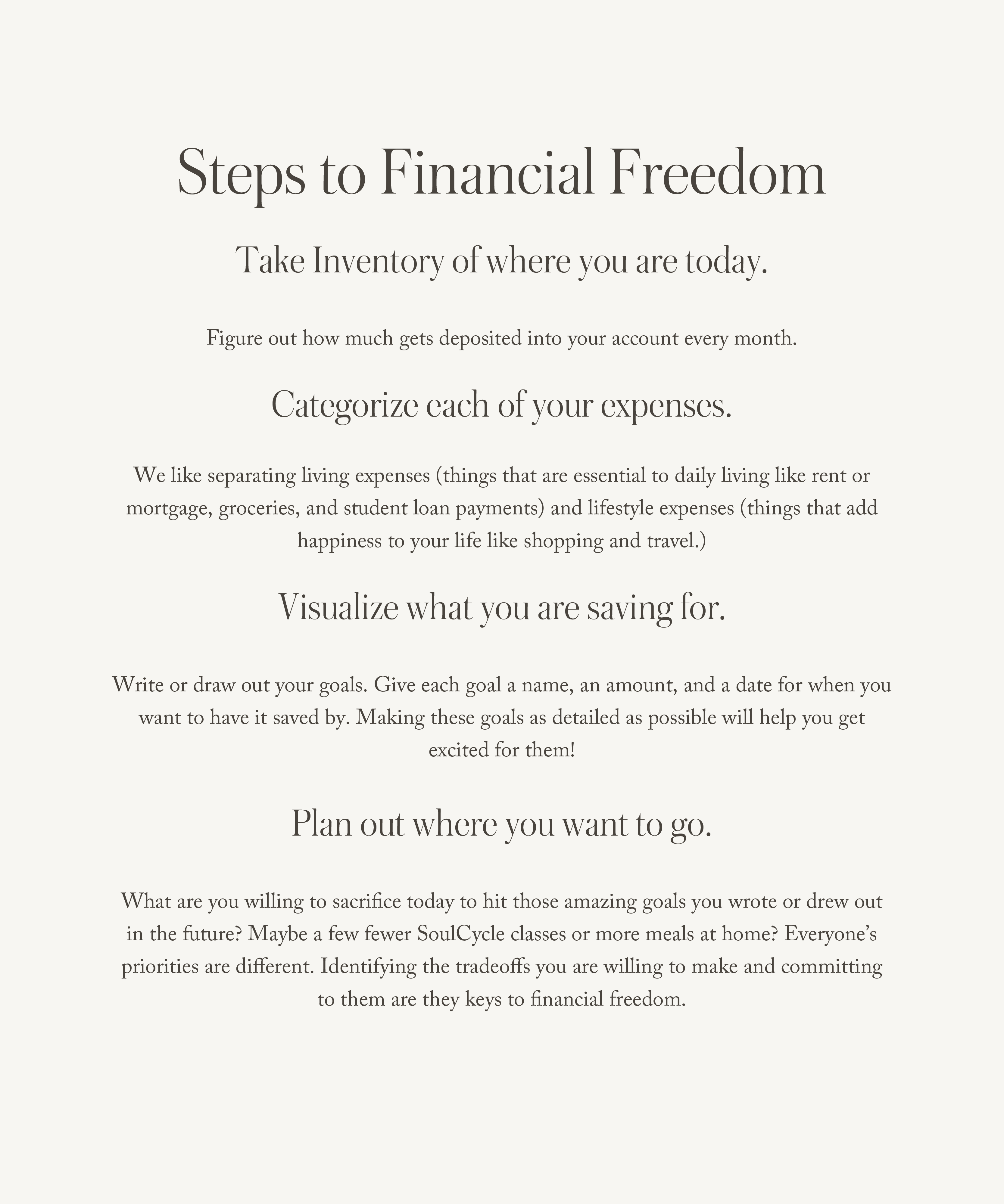

There are tons of surveys that show that a vast majority of Americans spend more than they make and are not saving enough. When someone wants to make a change to their spending—to stop living paycheck-to-paycheck—Mana recommends these steps:

Rip & Tan: The realities of Covid-19 pushed a lot of our financial goals by the wayside. What can we do to get back on track and set ourselves up for financial success as we enter the new year?

Mana: We see a lot of people’s finances, so we understand intimately that last year was merciless in some ways—job loss and financial insecurity upending our routines and lifestyles. 2020, however, didn’t play out for everyone that way. Some Americans had a hugely positive year when it came to their finances—savings rates are higher than normal and household net worths increased. We have some clients who bought houses and others who saw their companies going public—huge financial wins. No matter where you are currently, your goals are unique to you and it’s still possible to achieve them, even amidst a global financial crisis.

It’s hard to separate the emotions from reality, but we often remind our clients about the reality of the markets, which don’t mirror the economy. For example, if you invested in the U.S. stock market (as measured by the S&P 500) at the beginning of 2020 and stayed invested through year-end, you would have earned roughly 16% on your money. Obviously, no one could have predicted how the markets reacted to Covid-19, but it should give us more confidence.

Speaking of confidence, our core mission is to increase the financial confidence of our clients, especially women. When people lack confidence in investing, they sit on the sidelines, which means that they choose to stay in the safety of a checking or savings account rather than take the risks they know little about.

One way to increase your investing confidence in 2021 is to set an intention to learn a bit more about investing regularly. If you’re an online learner, you can subscribe to an online newsletter like The Morning Brew. You can listen to podcasts. We recommend anything created by Marketplace. If you’d rather turn the physical pages of a book, you can read a book about money or investing every month (or two). We’d recommend starting with our new favorite book on money and investing, The Psychology of Money: Timeless lessons on wealth, greed, and happiness, which was just released last year. When it comes to investing, even a little bit of knowledge can boost your confidence.

Rip & Tan: We hear things like, “Have 5 times your income saved by the time you’re 30,” but that’s not realistic for a lot of us. Is there a barometer for saving money that isn’t quite as intimidating as that one?

Mana: We think that generic financial rules of thumb tend to confuse more than they help. What (we think) that rule is trying to get at is the importance of having a cushion of money that you can tap in the event of an emergency, like if you get laid off, get a cavity or get in a car accident. It’s important that you have cash to tap instead of having to use credit cards (with punishingly high interest rates) to get you through a rough patch. After going through a bad experience, the last thing you want to have to take on is paying off debt. After paying off debt, you should aim to have an emergency fund equivalent to three months of your take-home pay. If you have a family, that fund should equal six months of take-home pay.

Rip & Tan: There is a statistic on your website that is shocking, but not totally surprising—61% of American women would rather talk about their own death than their financial future. Where does this fear come from, and what tools can we use to not be afraid to look at our bank accounts?

Mana: Women in America have historically been excluded from money decisions in the household, a tradition that’s thankfully beginning to be corrected. But in our experience many people, not just women, fear money. Feelings like anxiety, guilt and shame are common feelings when faced with money decisions. One thing I learned in my twenties is that fear thrives in the shadows; once you shed light on that fear, it begins to dissipate. A simple exercise is to get in the habit of looking at your bank account and credit card transactions on a weekly basis. Print your transactions out (or export them to Excel) and go through each transaction, highlighting the purchases that brought you joy. This simple exercise will get your brain to start associating happiness (instead of fear) with money and it will also help you make more mindful decisions about your money on a daily basis.

"Spend less than you make and invest the rest. It is so simple, but that message never really hit home until I turned 30. In a world where impulse spending is designed into our culture, this piece of advice is one I continue to remind myself of daily."

Rip & Tan: Are there any financial tasks we should check off our lists in the beginning days of 2021?

Mana: Start with a review of your goals. What are you saving for? Most of us get on autopilot after January and don’t regularly check in on what’s important to us and how we’re progressing towards those goals. Given the number of surprises and re-directions that happened to most of us in 2020, the beginning of this year is a perfect time to check back in.

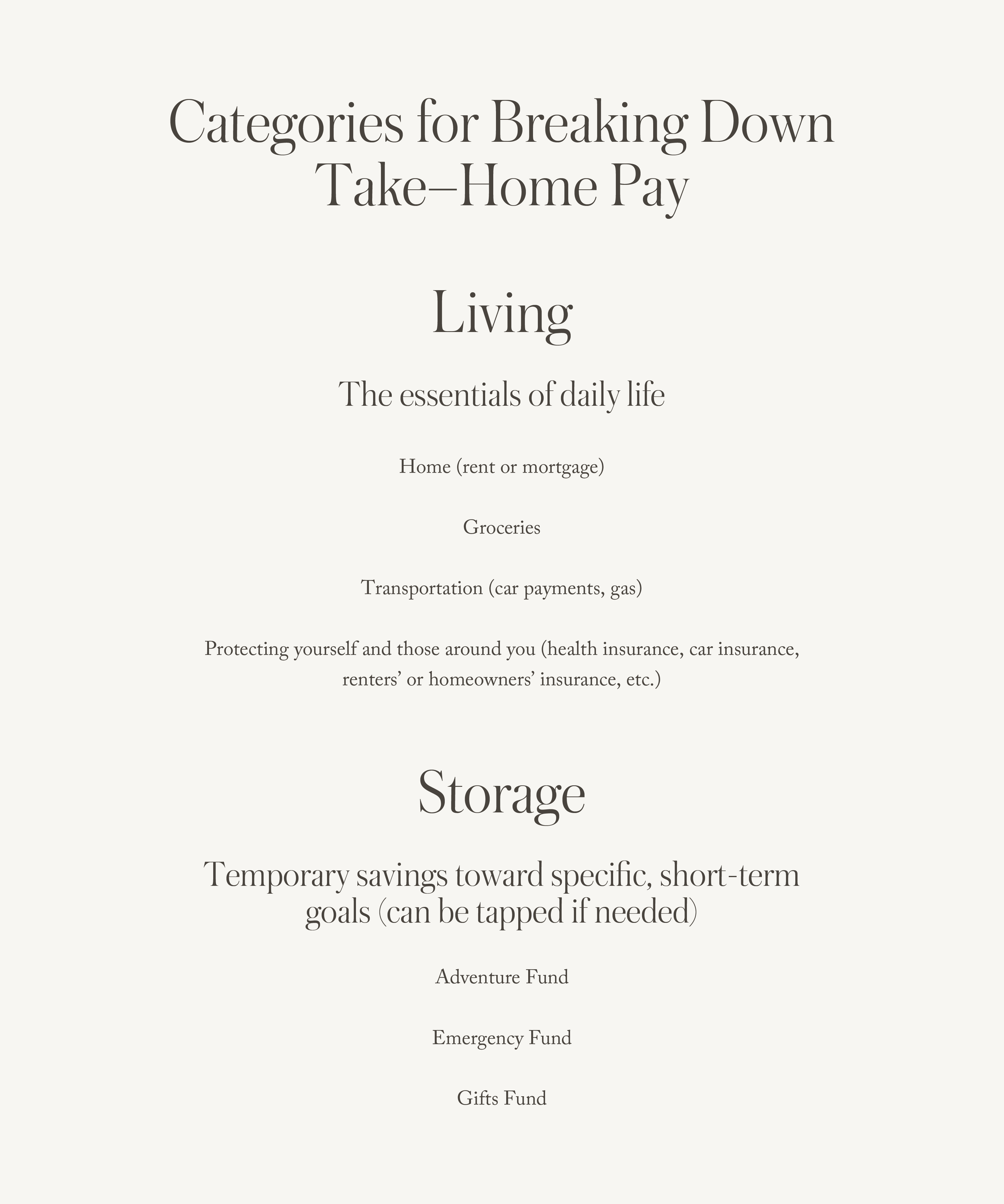

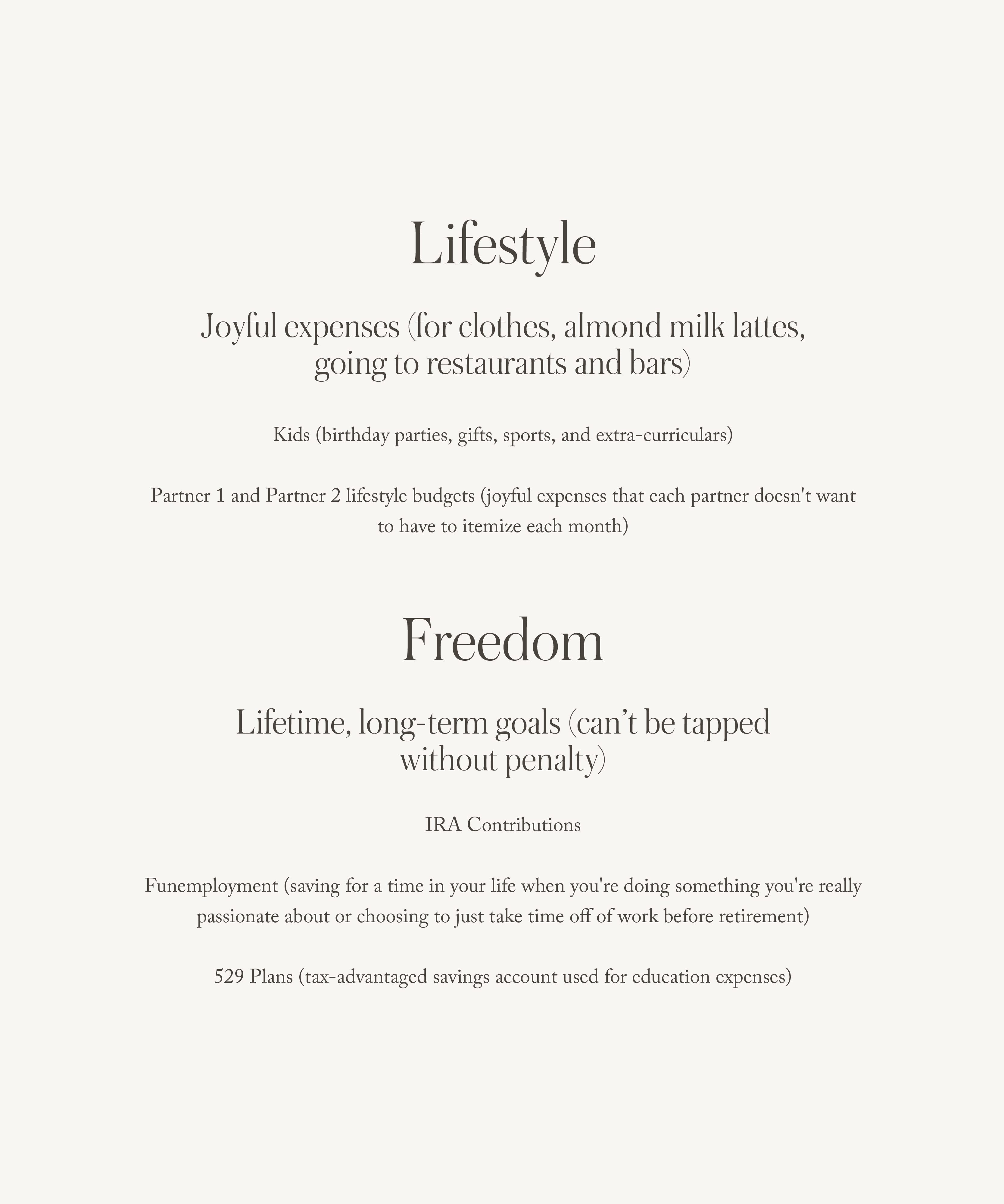

Once you have your goals in mind, review your Mindful Spending Plan and make adjustments for the new year. How much of your take home pay do you want to dedicate to essential expenses, savings, and joyful spending? Is your monthly saving amount sufficient to help you hit your goals?

Next, you’ll want to review and adjust your savings and investment contributions so they can help you meet your financial goals. Planning and prioritization of your goals is essential to a successful financial life. If one of your goals is to replenish your emergency fund in the new year, we’d recommend targeting three months of expenses (both essential and joyful) saved in a high yield savings account. If you have a family, we’d recommend keeping six months of expenses saved. If you want to max out your retirement contributions in 2021 in a 401k plan, (which we highly recommend!), you’ll need to set aside $1,625 each month.

Finally, think about the year ahead and brainstorm ways in which you (and your family) can save more money. Review your insurance policies. Are you still working from home indefinitely? Making sure the estimated mileage on your auto insurance policy reflects your WFH status can save you hundreds of dollars over a year.

If you pay for your own health insurance, make sure you update your estimated income for the year—if your income went down, your healthcare premiums will likely be reduced. Do an evaluation of all of your credit cards. Are you being charged annual fees? If you use a card regularly and like the perks, then a fee is ok; if you don’t use a card and are being charged a fee, it’s better to close it. Pick credit cards that align with your goals.

Rip & Tan: Any financial resolutions we should aim to make?

Mana: At Mana, we’re all about setting financial intentions. Unlike resolutions, intentions involve the act of you thinking more deeply about what you want your life to look like in the future and making this a regular practice in your life. Countless studies have proven that after writing out your intentions and saying them out loud, you’ve begun the process of living into a future reality where your intentions have become your reality. Financial intentions can encompass a whole range of topics, but here are a few examples of the financial intentions we make for ourselves each year:

– Defining your ‘enough’ in 2021.

– Being realistic and kind to yourself always, especially when it comes to money. Even being aware that you’re in debt is the first step to progress and should be acknowledged as progress in and of itself.

– Being open about finances. Tell your partner your goals and work together on joint goals. Accountability isn’t done in secret.

– Save with a purpose. You may not have the cash on hand to buy a house in LA tomorrow, but you can have it sooner than you think if you prioritize it over spending it on things that aren’t as important to you.

– Increase your net worth in 2021. Your net worth is a really simple, easy way to track your wealth over time. To calculate your net worth, you sum up all that you own (your assets) and subtract it by all that you owe (your liabilities) – the difference is your net worth. You can increase your net worth by saving more, paying down debt, and growing your investment assets. Ideally, it’s a combination of all three.

Photos by Jen Kay